|

||||||

|

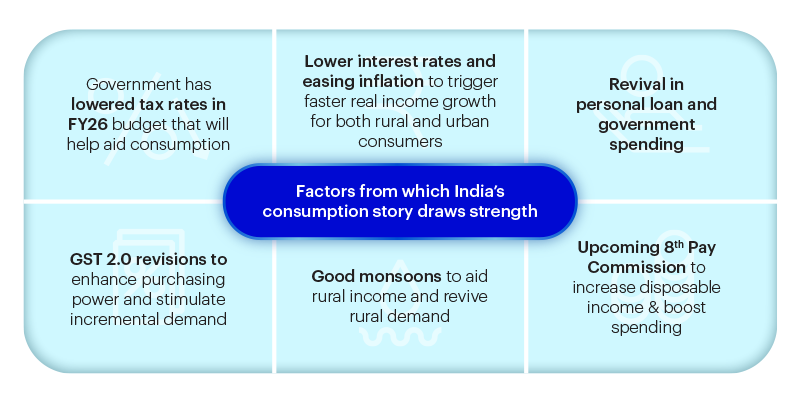

Rising incomes, rapid urbanization and a tech savvy aspirational population are reshaping consumption patterns across urban and rural markets. Further, quick commerce and e-commerce are enhancing convenience and also expanding market reach. We believe India would see a consumption led growth, where rising aspirations are translating into increased demand across categories.

|

||||||

|

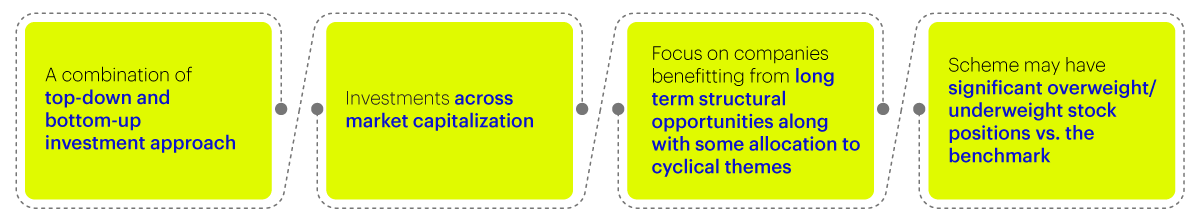

The Scheme aims to capitalize on India’s consumption story by investing across sectors and companies poised to benefit from rising income, urbanization and evolving consumer preferences & aspirations.

|

Consumer Services & Durables |

|

Telecom |

|

Fast Moving Consumer Goods |

|

Financial – Capital markets |

|

Automobile & Auto Components |

|

Realty |

|

Health & Wellness |

Hear directly from our Fund Manager

| Fund Managers | Mr. Manish Poddar & Mr. Amit Ganatra | |||||||||||||||||||||||||||||

| Minimum Investment | Lumpsum: ₹1,000 and in multiples of ₹1 thereafter | |||||||||||||||||||||||||||||

| Minimum SIP Amount |

|

|||||||||||||||||||||||||||||

| Benchmark Index | Nifty India Consumption TRI | |||||||

| Load Structure |

Exit Load#: For each purchase of units through Lumpsum / Switch-in / Systematic Investment Plan (SIP), Systematic Transfer Plan (STP) and IDCW Transfer Plan, exit load will be as follows:

|

|

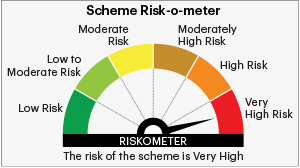

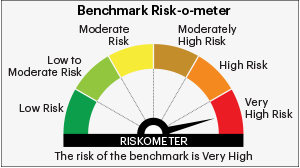

This product is suitable for investors who are seeking*: • Capital appreciation over long term • Investments predominantly in equity and equity related instruments of companies benefitting from consumption theme |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Note: The above product labelling assigned during the New Fund Offer (NFO) is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.