Closes in

Markets are dynamic and it is hard to predict which asset class will do well in a particular market condition. There are periods when equities outperform, while during uncertain times they may correct sharply. However, when equities are volatile, other asset classes such as debt, gold/silver may help limit the downside. In short, no single asset class can deliver in all types of market conditions.

Therefore it is prudent to diversify your investments across multiple asset classes, so when one asset class lags behind, the others can make up for it – helping to minimize volatility and maximize returns.

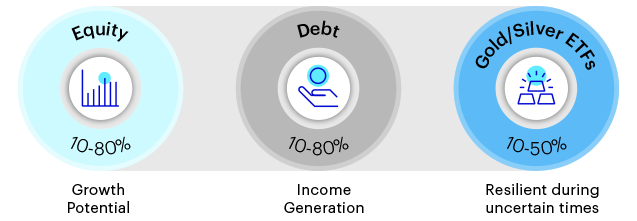

But selecting the right mix of assets in ever changing market conditions is hard. The smart thing to do is to invest in Multi Asset Allocation Funds. These funds invest in Equity, Debt, Gold/Silver with an aim to navigate different market conditions by dynamically allocating across asset classes to help optimize returns.

A fund which aims to pick the right assets at the right time and capture market opportunities

|

Benefits of 3 Gain exposure to Equity, Debt and Gold/Silver ETFs in one fund |

|

Actively Managed Monthly1 adjustments in asset allocation based on changing markets to optimize returns |

|

Expertise Informed asset allocation decisions using proprietary framework |

|

Wider Reach Dynamically invests in domestic and overseas equities2 |

|

Tax Efficient Benefit from Long Term Capital Gains taxation of 12.5% if held for over 24 months3 |

| Exposure to Overseas securities4 upto 35% of the portfolio |

| Fund Managers | Mr. Taher Badshah (Asset Allocation & Equities) & Mr. Herin Shah (Asset Allocation, Equities, Fixed Income & Gold/Silver ETFs) |

|

| Minimum Investment | Rs.1,000 and in multiples of Re.1 thereafter | |

| SIP Amount | Rs.500 and in multiples of Re.1 thereafter | |

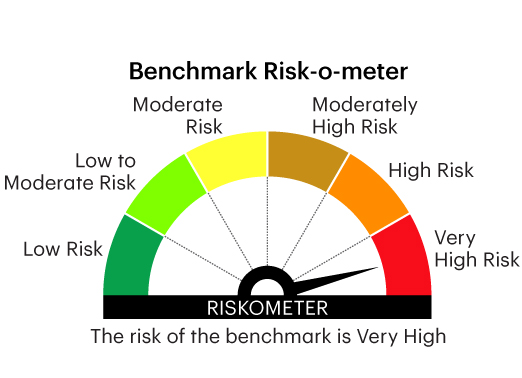

| Benchmark | Nifty 200 TRI (60%) + CRISIL 10 year Gilt Index (30%) + Domestic Price of Gold (5%) + Domestic Price of Silver (5%) |

| Exit Load5 |

For each purchase of units through Lumpsum / Switch-in / Systematic Investment Plan (SIP), Systematic Transfer Plan (STP) and IDCW Transfer Plan, exit load will be as follows:

|

|

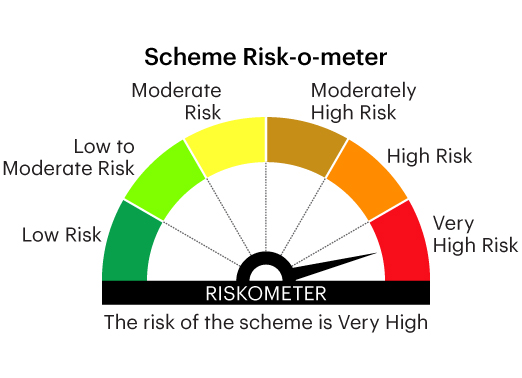

This product is suitable for investors who are seeking*: • Capital appreciation/income over long term • Investment in diversified portfolio of instruments across multiple asset classes. |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

Note: The product labelling assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.